Dear Members of the

Acorda Community:

2012 marked a critical transition for Acorda, as we achieved several milestones that positioned the Company for long-term growth and leadership in neurology product development and commercialization. These included:

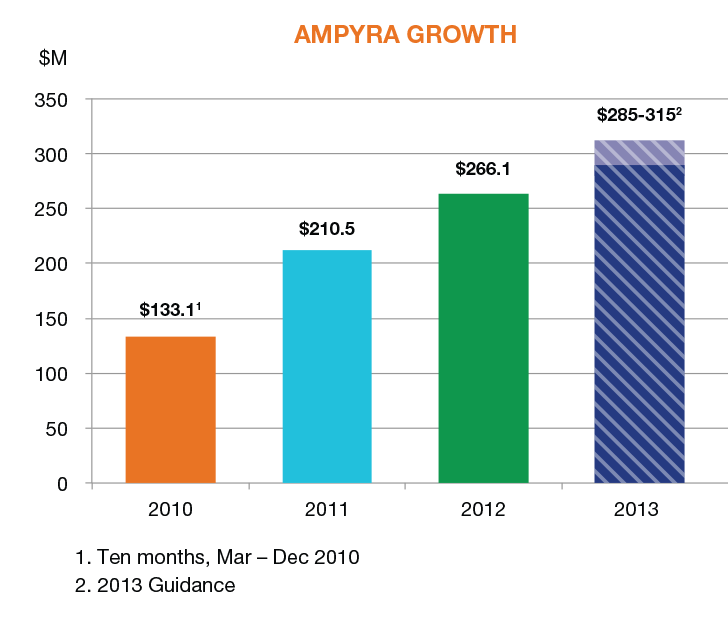

- $266.1 million in net sales of AMPYRA® (dalfampridine) Extended Release Tablets, 10 mg, a 26% increase over 2011;

- acquisition of a novel product, Diazepam Nasal Spray for cluster seizures, for which an NDA filing is expected in 2013;

- conducting two proof-of-concept Phase 2 clinical trials (completed in April 2013) exploring the potential of dalfampridine extended release tablets in the treatment of post-stroke deficits and cerebral palsy; study found dalfampridine improved walking in people with post-stroke deficits;

- completing the first Phase 1 clinical trial of GGF2 in heart failure with positive efficacy signals; and

- successfully filing an IND for rHIgM22 for remyelination in multiple sclerosis (MS).

Based on these milestones, in 2013 we expect to have at least five product opportunities in various stages of clinical development and/or NDA review.

CONTINUED GROWTH FOR AMPYRA

More than 75,000 people with MS have tried AMPYRA in the U.S. since its launch in March 2010. This breakthrough therapy has helped tens of thousands of people to improve their walking; it represents a unique contribution by Acorda to the treatment of MS, one that is highly valued by people with this challenging disease.

AMPYRA has shown consistent year-over-year growth since approval. In 2012, we closed the year with $266.1 million in net sales, a 26% increase over 2011. Our 2013 net sales guidance of $285-315 million reflects our confidence that we can continue to build AMPYRA through a combination of organic growth and pricing adjustments.

To support future AMPYRA sales growth, we will continue to develop or expand innovative commercial strategies, such as our highly successful First Step and patient outreach programs. We are also piloting initiatives that encourage people who are benefiting from therapy to continue to take AMPYRA as prescribed. At the same time, we continue to focus on the cost-effectiveness of these initiatives, and project that commercial AMPYRA spend will be essentially the same in 2013 as in 2012, and significantly lower as a percentage of sales.

To support future AMPYRA sales growth, we will continue to develop or expand innovative commercial strategies, such as our highly successful First Step and patient outreach programs. We are also piloting initiatives that encourage people who are benefiting from therapy to continue to take AMPYRA as prescribed. At the same time, we continue to focus on the cost-effectiveness of these initiatives, and project that commercial AMPYRA spend will be essentially the same in 2013 as in 2012, and significantly lower as a percentage of sales.

We are also exploring the potential of dalfampridine extended release tablets to help people with other neurological conditions and other indications within MS. These programs are discussed in more detail in the pipeline section of this letter.

MARKET STATUS OF ZANAFLEX® FRANCHISE AND FAMPYRA®

In 2005, we launched our first commercial product, ZANAFLEX CAPSULES® (tizanidine hydrochloride). At the time, we viewed this product as a strategic bridge to enable us to build a commercial infrastructure that would ultimately support the launch of AMPYRA. This strategy not only succeeded in that purpose, but the Zanaflex franchise ultimately generated far more revenue than our original projections. Market exclusivity for the Zanaflex franchise ended in February 2012. However, despite generic competition, we have continued to generate modest incremental revenue through both branded sales and royalties that we receive from Actavis, Inc. on sales of an authorized generic version of ZANAFLEX CAPSULES.

AMPYRA has been launched in several ex-U.S. markets by our partner, Biogen Idec, under the brand name FAMPYRA (prolonged-release fampridine tablets), and Biogen is continuing to roll out additional launches. FAMPYRA has been enthusiastically received by physicians and people living with MS, with strong product demand — through the end of 2012, more than 45,000 people with MS had tried FAMPYRA.

However, the global reimbursement environment has become progressively more restrictive, particularly in Europe. For now, we expect European reimbursement for FAMPYRA to remain challenging, but with a foundation of strong fundamental demand for FAMPYRA.

KEY ADDITION: DIAZEPAM NASAL SPRAY

In December 2012, we finalized our acquisition of Neuronex, Inc., adding Diazepam Nasal Spray to our development pipeline. This proprietary formulation of diazepam is a potential acute treatment for people with epilepsy who experience cluster seizures, also known as acute repetitive seizures, which are not controlled by their other anti-epileptic medications. Outpatient treatment for cluster seizures is limited to diazepam administered as a rectal gel, which significantly limits acceptance by adult and older pediatric patients; a nasal formulation has the potential to introduce a more convenient mode of delivery that would mark an important advance in patient care.

We are currently preparing a New Drug Application (NDA) for this product. Pending completion of certain manufacturing tests, we anticipate filing the NDA later in 2013. If the FDA review proceeds successfully, Diazepam Nasal Spray may be on the market as early as 2014. This product would leverage our existing commercial infrastructure, and we do not anticipate that we would need to expand our sales force significantly, if at all, to support it. If launched, this product should quickly be accretive to our bottom line.

In April 2013, three-month data from the Phase 1 GGF2 clinical trial in heart failure patients were highlighted at the American College of Cardiology meeting, the premier medical conference for cardiovascular physicians. These data were presented by our academic collaborator, Vanderbilt Medical Center.

ADVANCING PIPELINE

As a result of our patient and methodical investments in product development, we believe the Acorda pipeline is now one of the most promising in the neurology space, encompassing five separate products at clinical or pre-NDA stage.

Drug development is an expensive, high-risk enterprise. To mitigate risk, our approach has been to design blinded preclinical trials that provide reproducible results in validated preclinical models, where available, and stepwise clinical trials that provide clear "go/no go" endpoints. This approach allows us to make graduated, controllable increases in investment, based entirely on how much risk has been eliminated at a given point. As a result, we have abandoned numerous product opportunities since the Company's founding in 1995, and advanced only those that have met our rigorous criteria.

Our approach is well-illustrated by the results that we announced in April 2013 from two studies exploring the use of extended release dalfampridine in new disease areas: post-stroke deficits and cerebral palsy (CP).

Consistent with preclinical data, dalfampridine extended release tablets improved walking in people with post-stroke deficits, and we are therefore planning to continue clinical development in this area. There are more than seven million stroke survivors in the U.S., and more than half have mobility impairment. There are no medications currently available for these patients, so new therapies are desperately needed.

Efficacy data from the CP study suggested potential treatment activity on measures of walking and hand strength; however, we are still analyzing these data to determine if they are sufficiently robust to warrant further clinical studies.

Importantly, safety findings from both the post-stroke deficits and CP studies were consistent with previous AMPYRA clinical trials and post-marketing experience in MS.

Our GGF2 program, likewise, exemplifies our approach to prudent R&D management. After years of meticulous preclinical studies that informed clinical trial design, in late 2012 we completed the first clinical trial of GGF2 in patients with heart failure. This trial was primarily a safety and tolerability study, but echocardiography revealed a long-lasting, dose-dependent improvement in cardiac ejection fractions that mirrored our preclinical data. These data were impressive enough to be awarded a platform presentation at the American College of Cardiology Meeting in April 2013. We have discussed these data with the FDA and have reached agreement on the next clinical study. This next study will primarily investigate further the safety profile of GGF2 across a range of doses, and will continue to explore efficacy outcomes. The FDA has granted Fast Track designation for GGF2 for the treatment of heart failure.

GGF2 has also shown promise in improving motor function in preclinical models of acute stroke, and in restoring erectile function in preclinical models of cavernous nerve injury, the same nerve that is routinely injured in men undergoing prostate surgeries. If GGF2 continues to show promise in our clinical program in heart failure, we plan also to develop it for neurological indications in the future.

We also initiated a new clinical program in April 2013, enrolling the first patient in a Phase 1 clinical trial for rHIgM22 to evaluate myelin repair in MS. rHIgM22 has shown the ability to repair myelin in several preclinical models of MS.

Another clinical stage product, AC105, has shown promise in preclinical models of acute spinal cord injury (SCI), brain trauma and stroke. We are planning to initiate a Phase 2 clinical trial in AC105 later this year, pending results of additional preclinical data.

2013 Clinical and Regulatory Milestones

- Top-line data from extended release dalfampridine post-stroke deficits and cerebral palsy studies announced April 2013; study found dalfampridine improved walking in people with post-stroke deficits

- NDA filing for Diazepam Nasal Spray (2H 2013)

- Initiation of Phase 2 clinical trial for AC105 in acute SCI (2H 2013, pending results of additional preclinical data)

- Initiation of Phase 1 clinical trial for rHIgM22 in MS (April 2013)

- Initiation of second GGF2 clinical trial in heart failure (2H 2013)

PROFITABILITY AND GROWTH

We believe that the Company is now positioned advantageously to leverage its assets for future growth. These significant assets include: a seasoned team of executives with proven records of identifying and successfully developing opportunities that have not been obvious to others; a highly skilled, accomplished commercial organization in the specialty neurology space; and a disciplined approach to business and drug development that has yielded a promising and diversified clinical stage pipeline.

Our priorities are to maximize our commercial opportunities with AMPYRA and expand them where possible, to acquire new commercial or near-commercial stage opportunities that leverage our existing commercial organization, and to invest in the potential of our pipeline to fuel future growth. We also seek to achieve a reasonable balance between current profitability and future growth. Where we set this balance will be determined at any given time by the quality, stage and size of our pipeline opportunities.

On behalf of my associates at Acorda and our Board of Directors, I thank you for your continuing support of our mission to bring novel therapies to people with neurological diseases, and look forward to keeping you informed of our progress in 2013.

- Ron Cohen

- President and Chief Executive Officer